The Ultimate Guide

Let's start with the fundamentals of crypto arbitrage Trading: what it is and how it works. To begin, trading arbitrage crypto is not like other types of digital currency investment, which expose you to losses due to crypto market volatility. Rather, it profits from transient pricing inefficiencies among exchanges.

Simply put, cryptocurrency arbitrage entails taking advantage of the fact that a coin might be accessible on several crypto exchanges at various rates at the same time for a limited time.

To profit, you will purchase the coin on the exchange with the lowest price, then immediately sell it on the exchange with the highest price and pocket the difference. The price differential may only exist for a limited period, therefore you must act quickly to capitalize on the chance before the market adjusts and the inefficiency is corrected.

Price discrepancies may be caused by a variety of factors, including variable

levels of activity and disparities in supply and demand among exchanges.

What Are the Different Types of Cryptocurrency Arbitrage

There are several techniques to foresting arbitrage crypto. We'll begin

with the most basic kind of arbitrage crypto. As previously stated, this

includes taking advantage of minor price discrepancies across exchanges by

purchasing the currency on one exchange and then selling it on another.

Another technique is to buy and sell two currency pairings at the same time,

taking advantage of order book disparities by executing transactions on both

pairs at the same time.

Volatility in volume arbitrage crypto includes using the fact that exchanges

have varying degrees of trading activity, and exchanges with lesser traffic

will have more price volatility, which may be exploited. Margin arbitrage is

another strategy in which you acquire the coin on one exchange and then sell

it on another where you believe it is being sold at a lower price.

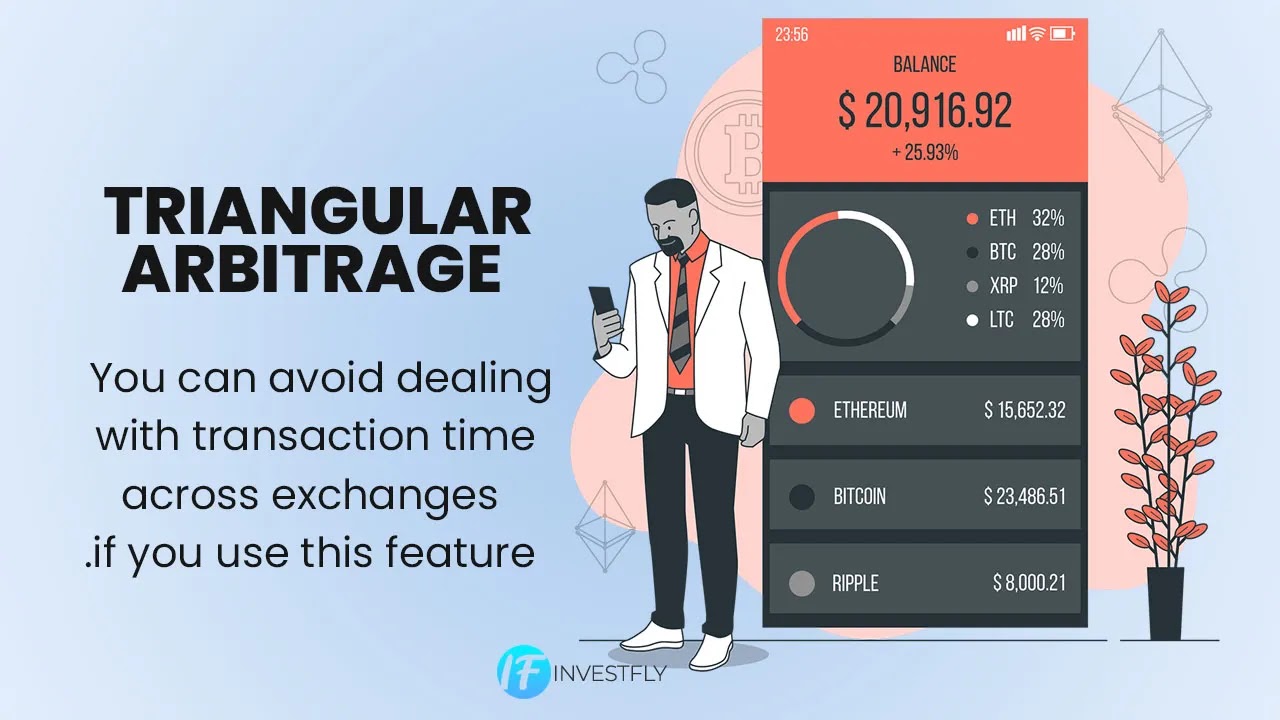

Finally, there is triangle arbitrage, which is a somewhat more

difficult method.

What is Triangular Arbitrage?

This rather sophisticated method entails purchasing and selling many base

pairs in the same exchange for the same digital commodity. This allows

you to take advantage of arbitrage possibilities on ssdsqdsqdqsdsqdsqeveral crypto

marketplaces while avoiding the issues that come with having to monitor

numerous exchanges at the same time.

It operates by using three distinct pairings, such as LTC/BTC, LTC/ETH, and

ETH/BTC. Begin by purchasing LTC/BTC, which will initiate your arbitrage

triangle. This will then be converted to LTC/ETH, which will be linked to the

previous pair and the next asset in the triangle loop. After that, you trade

to your third currency, ETH/BTC, which is linked to both the first and second

pairings. This trade locks in your profit from the rate discrepancies between

the three pairs. All that remains is to convert the third currency into your

original asset.

The benefit of this form of arbitrage crypto is that it eliminates the need to deal with transaction latency between exchanges. However, you must be cautious not to lose too much money by paying fees on every stage of the transaction and restrictions, and you are making more on your trade than you are spending to execute it.

What Are the Best Tools for Taking Advantage of Crypto Arbitrage Opportunities?

The top bitcoin arbitrage software tools can streamline and accelerate your

arbitrage attempts while being user-friendly and efficient. Many of them are

also absolutely free of charge. Sites like CoinMarketCap or

CoinGecko, for example, will supply up-to-date crypto market data, allowing you to

spot price disparities across various exchange listings volumes and grasp

chances on all sorts of altcoins. There are also arbitrage crypto calculators

and portfolio trackers such as

Blockfolio and

CoinStats that allow you

to monitor crypto pairings across exchanges and seek price disparities.

However, the most critical instrument of all is a crypto arbitrage algorithm.

A crypto arbitrage approach is almost probably best implemented via an

automated, algorithmic trading platform.

Is Crypto Arbitrage Dangerous?

While crypto arbitrage is generally relatively low risk when compared to

speculative digital currency investment, there are some considerations

to consider to adequately preserve your wealth.

To begin, choose a cryptocurrency arbitrage program that does not

charge exorbitant withdrawal costs and enables quick transfers since market

inefficiencies are often transient.

You don't want other traders to close the gap before you can benefit, thus

it's a good idea to keep coins on exchanges so you can react fast to arbitrage

chances.

What Are the Benefits of Arbitrage Crypto Software?

A crypto arbitrage algorithm may scan many exchanges in low-low volume

at the same time, monitoring hundreds of cryptocurrencies at the same time to

find inefficiencies and exploit them at lightning speed before the market

corrects and the price discrepancy resolves itself. When you automate your

crypto arbitrage, you may also conduct a large number of deals at the same

time, at a speed and efficiency that no person can equal.

The most significant advantages of automated arbitrage crypto are that it does not involve specialized financial knowledge, time-consuming research into price discrepancies, trading activity on high and low-volume exchanges, or hours spent in front of a screen completing deals.

Arbitrage Crypto and Regulation

Crypto arbitrage, like other kinds of cryptocurrency trading, is governed by

various laws depending on your location. You must be informed of the present

regulatory position of digital assets in your location, as well as local labor

in terms of trading, taxes, cons, and user safeguards. This is a relatively

new growing asset class, and authorities throughout the globe are attempting,

with varying degrees of success, to keep up with fast advances in the crypto

realm.

When utilizing an exchange, trading platform, or tool, you must confirm that the service provider is trustworthy, since the crypto arena is notorious for its anonymity and lack of regulation. The easiest method to do this is to only give your money or data to a registered and regulated firm.

Last Thoughts

Crypto arbitrage is growing in popularity, not just among ordinary investors but also among hedge funds, financial institutions, and investment businesses. It requires little work and provides huge returns, giving the speed and profitability of bitcoin with almost little risk.

©ِ Copyright : InvestZZ Blog